The Federal Reserve (the Fed) has been mandated to promote maximum employment and price stability in the United States since 1977. However, the approach and tools used to achieve these goals have evolved over time. Although monetary policy has undergone substantial change post-2008, most curricula and educational resources have not been sufficiently updated to reflect this shift. Therefore, this article will attempt to explain how the implementation of monetary policy post-2008 diverges from much of the material that students are likely to come across in their textbooks.

The Limited-reserves Regime (pre-2008)

Before 2008, the Fed followed a policy framework in which it provided limited reserves to the banking system. Bank reserves were typically divided into two categories: required reserves, and excess reserves. Required reserves are funds that banks must keep in reserve against certain deposits in the form of vault cash or deposits with Federal Reserve Banks. Excess reserves are the amount of funds held by banks in their accounts at Federal Reserve Banks in excess of their required reserves balance.

Banks held reserves to comply with the Fed’s regulatory reserve requirements and to ensure they had sufficient funds to meet the needs of their customers. Since reserves did not earn interest, banks usually held only fractionally more than what was required. When banks required additional reserves, they would borrow reserves in the federal funds market. Conversely, if banks had excess reserves, they could lend them in the federal funds market. The interest on these loans was charged at the federal funds rate (FFR), which is the interest rate that banks charge each other for overnight lending.

The FFR is important, because it effects other short-term and long-term interest rates which in turn effect consumer’s and producer’s spending decisions. Therefore, as part of its monetary policy the Fed sets a federal funds target rate. This is a range within which the FFR may fluctuate.

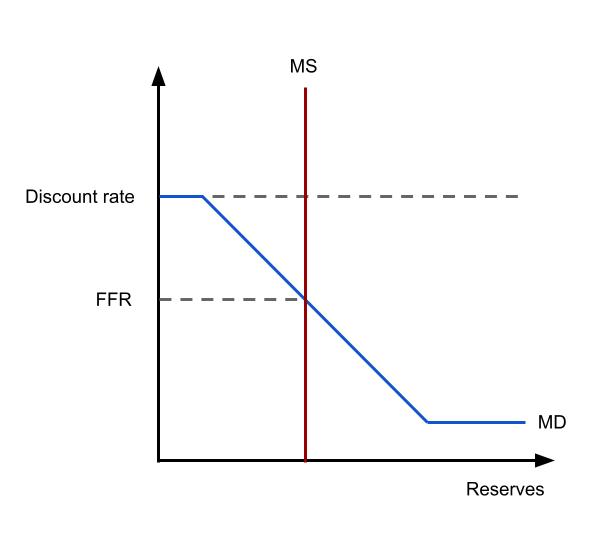

Refer to Figure 1.1 – The Fed would use open market operations (OMO), such as buying or selling government securities, to influence the money supply (MS) in the banking system relative to banks’ demand for reserves (MD) and thereby influence the FFR to move within the target range. Note that the discount rate in the diagram is the rate at which the Fed will borrow money to commercial banks, and acts as a ‘ceiling’ on the FFR.1The discount rate acts a ceiling on the FFR. If the FFR were to exceed the discount rate, commercial banks would have an incentive to borrow from the central bank at the discount rate instead of borrowing from each other at the FFR. This would put downward pressure on the FFR.

However, under the limited-reserves regime, the Fed only had limited control over the FFR, and it could be affected by other factors such as changes in the demand for reserves or disruptions in financial markets. This system proved to be less effective during the financial crisis, as the Fed had to resort to unconventional policy tools such as quantitative easing to provide the necessary liquidity to the banking system. Therefore, a new framework was required in order to effectively manipulate the FFR.

The Ample-reserves Regime (post-2008)

After the Global Financial Crisis of 2007-2009, the Fed adopted an ample-reserves approach to implement monetary policy. This approach refers to the quantity of reserves commercial banks hold at the central bank in relation to their demand for money. This regime resulted from the significant increase in the money supply post-financial crisis, which provided commercial banks with access to abundant reserves.

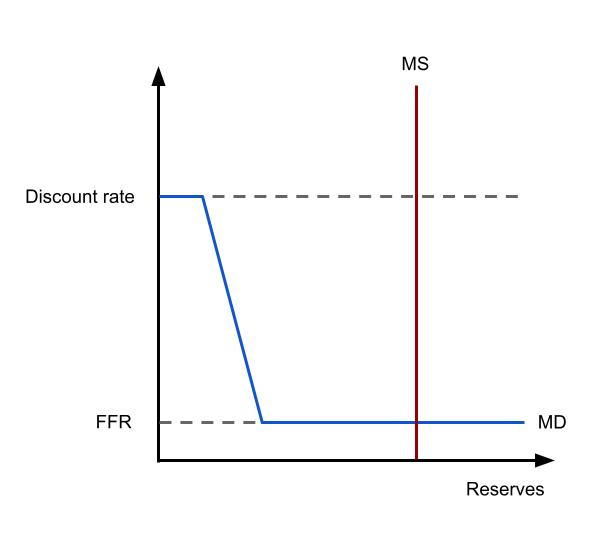

Refer to Figure 1.2 – To be in an ample-reserves regime, the Fed’s supply curve must intersect at the flat portion of the banks’ demand curve. In this situation, a change in the money supply would have no significant impact on the equilibrium FFR. Consequently, the Fed cannot manipulate the rate by changing the money supply within this range. Therefore, the Fed required a new mechanism by which to increase and decrease interest rates under an ample-reserves regime.

The Federal Reserve’s Administered Rates

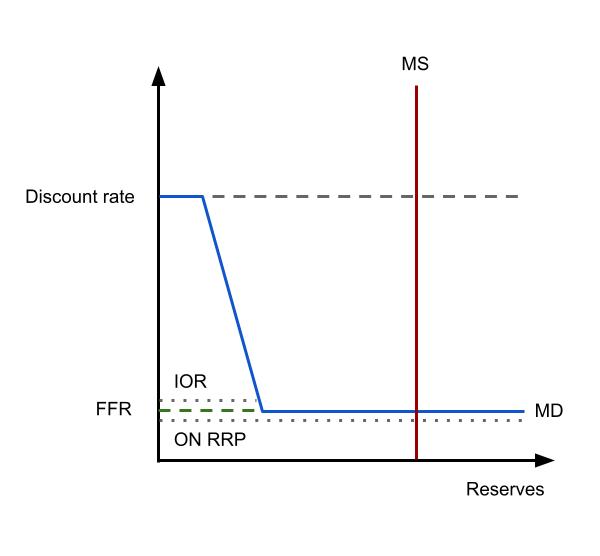

As noted earlier, when the banking system holds a substantial amount of reserves, the Fed’s ability to affect the FFR through adjustments to the money supply becomes limited. Therefore, within the framework of ample-reserves, the Fed instead uses its administered rates in order to influence the FFR. These administered rates include the interest on reserves (IOR) rate and the overnight reverse repurchase agreement (ON RRP) rate.

The IOR rate is the interest rate that commercial banks receive for holding bank reserves at the Fed. Depositing reserves at the Fed and receiving the IOR rate represents an attractive choice for banks, since it is both a secure and risk-free investment. As a result, banks are unlikely to lend out reserves in the federal funds market for less than the IOR rate. The IOR rate is therefore the primary mechanism used by the Fed to set a ‘floor’ on the FFR.2If the FFR drops significantly below the IOR rate, banks may borrow in the federal funds market and deposit the reserves at the Fed to earn a profit. In this way, the IOR acts as a ‘soft floor’ for the FFR.

However, not all institutions with reserve accounts are eligible to earn interest on their deposits at the Fed. Additionally, certain important institutions within financial markets may not have an account with the Fed altogether. Because these institutions are not able to receive interest on their deposits this raises the possibility that the FFR could fall below the IOR rate. Consequently, the lower limit established by the IOR rate is commonly known as a ‘soft floor’, due to the tendency for the FFR to fall slightly below it.

In response, institutions not eligible for the IOR rate were granted permission to place their reserves at the Fed overnight, receiving a security in exchange as collateral, with the Fed pledging to repurchase the security at the ON RRP rate. This arrangement provides a safe and secure investment alternative for these institutions. Thus, the ON RRP acts as a supplementary floor that reinforces the “soft floor” set by the IOR rate.

Refer to Figure 1.3 – To establish a range for the FFR, the Fed increases or decreases both the IOR and ON RRP rates simultaneously. The upward or downward movement of both interest rates shifts the flat portion of the money demand curve, resulting in a corresponding change in the FFR. The diagram shows that the FFR usually settles between the Fed’s IOR and ON RRP rates. This system has proved to be highly resilient and effective.

The Fed has communicated its intentions to continue operating within an ample-reserves regime. Thus, there is no plan to return to the limited-reserves regime that existed prior to the financial crisis.

Author Profile

- Luke Watson has a BSc (Hons) in international business and economics. He is currently working as an IBDP economics teacher at Shanghai United International School in China.

Latest entries

- March 10, 2023CourseHow the Fed Sets Interest Rates Post-Crisis

- February 5, 2023CourseHow to Calculate the Gini Coefficient Using the Lorenz Curve

- January 29, 2023CourseHow to Score Full Marks on the Economics IA

- January 29, 2023CourseHow to Effectively Structure Your Economics IA

Comments are closed